Are you a boxing fan? I am, although in the last few years I have lost interest in the sport due to the many judging controversies and the lack of really, really great fights.

Are you a boxing fan? I am, although in the last few years I have lost interest in the sport due to the many judging controversies and the lack of really, really great fights.

I recently watched a documentary of the great 1980 fight between Sugar Ray Leonard and Roberto “Hands of Stone” Durán. It was the infamous “No Mas” fight.

It reminded me that while I was growing up, there would always be a great fight on the horizon.

How is boxing related to finances? Well, I think it’s time to have a great fight between two financial numbers. I believe most of the advice offered today by the conventional wisdom is focused on the short term as opposed to the long term impact on your financial wellness.

And focus is key for your finances. You need to pay attention and take control of your money. But remember, in money and in life whatever gets your focus and attention will be what generally improves.

So where should you and I focus? I want to start a great fight (i.e., conversation) about these two financial numbers: Net Worth vs. FICO Score.

Let’s agree that for these two numbers, the greater the number the better the situation. And let’s see which one is more beneficial to your long term financial wellness.

So let’s get ready to rumble!!!!

Tale of the Tape: FICO Score

What is it? The FICO score simply measures your level of interaction with debt. How much you money you owe, the type of debt, the length of your debt history, record of payments, etc.

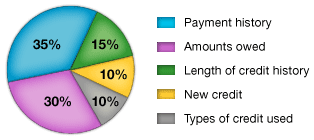

Here are the components of your FICO Score (via the FICO website):

In other words, the algorithm for computing your FICO score does not take into account your salary, length of time in your current position, or your level of savings and investments.

Why do you need it? Well, if you want to borrow money for anything, a FICO score is one of the key components used by lenders to assess your credit worthiness.

The only reason to really worry about having a good FICO score is because you want to borrow more money. A bigger FICO score means lower interest and higher borrowing limits.

The biggest reason the conventional wisdom says you need a good to great FICO score is to borrow money for a home. But let me tell you this: my wife and I refinanced our home 3 years ago and the FICO score was just one component of the process.

The bank still wanted to know that I had a steady job, that I had enough money saved for a good down payment, and that we had very little or no debt.

Furthermore, the new borrowing guidelines that went into effect this year are taking us back to more traditional lending practices. So, the FICO score is not the main component in whether or not you get a mortgage.

How can you improve it? Well, there is only way to maintain a good FICO score. You have to borrow money all the time and pay it back in time. You don’t want to be late and you don’t want to have “bad debt” on your record.

In other words, you have to be in the endless cycle of having open credit lines, borrowing money, and paying it back. It seems to me that it is like a dog chasing its’ tail: borrow money to improve my FICO score so I can borrow more money.

You could inherit $1M and your FICO score would not be affected. You could work very hard at your job and get that promotion making more money and it would not change your FICO score. You could finish that bachelor’s or master’s degree to get a better job with better pay and your FICO score would not be affected.

You could have $25K in an emergency fund and $300K in your 401K and $100K in mutual funds and your FICO score would not change. And you could own your home and 2 rental properties free and clear and your FICO score would not change.

So the FICO score is all about going into debt and staying into debt. Having a high FICO score means that you are very good at jumping through the hoops of going into debt.

And yes, I know that some insurance companies, landlords, and employers are starting to use the FICO score to determine the worthiness of applicants.

I personally think that’s the wrong element to measure. A low or inexistent FICO score could indicate a person that is not responsible with money.

But it could also represent someone who has no debt, has savings, investments, and has no need to borrow money.

If a company is not smart enough to realize that and look deeper into my financial situation, then maybe I don’t want to be in business with them.

Note: Here is some interesting insight on the use of the FICO score for renting from my fellow PF blogger Devin Czech.

Tale of the Tape: Net Worth

What is it? Your net worth is the difference between your assets (what you own) and your liabilities (what you owe).

Net Worth = Value of Assets – Total Liabilities

Why do you need it? Well, it is very simple. As you go through life your financial position is better when you have more assets that you own free clear and very little in liabilities.

Think about this. When you are 65, would you prefer to own your home free and clear or be facing retirement years still carrying a mortgage?

Would you like to have the freedom to choose when to stop working or having to work because you still need the money to service your debt?

The greater your net worth, the more options you have to do what you really want to do in life.

How can you improve it? You have to work to increase your assets and reduce or eliminate your liabilities. In his must read book, “Rich Dad, Poor Dad”, Robert Kiyosaki explains it this way:

“In financial reporting, reading numbers is looking for the plot, the story. The story of where the cash is flowing. In 80 percent of most families, the financial story is a story of working hard in an effort to get ahead.

Not because they don’t make money. But because they spend their lives buying liabilities instead of assets.”

So how do we do this? How do we put our focus on increasing our net worth?

- Increasing your assets: Get on a budget (spend less than you make), save money for emergencies, invest for retirement and for college. Invest for wealth building in mutual funds and real estate.

- Reducing your liabilities: Pay off your credit cards, car loans, student loans. Stop borrowing money. Pay off the mortgage early.

The Decision

Well, for me the decision is very clear. I am going to focus on improving my net worth and not worry about my FICO score. I will keep an eye on my credit report and check it at least once a year for accuracy.

The FICO score has a limited scope and it’s focused on the short term. And I don’t want to live my financial life using the crutch of debt.

I want to focus on the long term. And I can impact my net worth by taking charge of my finances. I can focus, take control of my money, and really influence my overall financial wellness.

In my mind, net worth is the clear winner in this fight. It is the true measure of winning with money.

Question: What do you think? What number will be your focus?

This post is also available in: Spanish